We get a ton of questions about my different trading strategies and my Master Indicator…

So with today being a market holiday and no order flow hitting my personal options scanner, I figured it’s the perfect time to go over the different strategies.

First and foremost, a couple of things…

Options are my bread and butter… And even more specifically, I like to follow “unusual options activity” orders that hit my personal options scanner.

My scanner sweeps for unusual orders of $100,000 or more that aren’t tied to a spread.

I also like what I call “cheap options,” which cost around $1.00 a contract.

Now let’s briefly break down each strategy. Keep in mind that things evolve over time, and also I may tweak some things depending on what type of market we’re in.

Alpha Sweet Alerts

With this service, my goal is to help you get in on trades that insiders are targeting, and we follow the money.

There’s generally only one reason insiders buy shares of their own company — because they think they’re undervalued and about to move higher.

Once an insider places a trade, a signal triggers — one that helps forecast price movements. These “Alpha Sweep Alerts” help you to level the playing field with elite traders.

Heavyweight Trades

I select trades based on technicals from my Master Indicator and use options flow to confirm the opportunity. This mostly a swing trading service.

The Master Indicator

I spent years developing the code for my Master Indicator, and it leverages the real driving forces behind a stock’s movement. It’s mainly used for day and swing trading (1-, 5- and 15-minute time frames), but also for long-term buy-and-hold positions (daily time frame).

Money Crew Masters

This service includes two separate strategies…

Sweet Spot Stocks is a long-term holding strategy of small stocks that I see being on the verge of big gains.

Bang Trades are the biggest options trades on the most liquid, large-cap stocks on the market. After the dust settles, I’ll help you grab the chance to move into the exact same positions at a better price — with the smart money’s million-dollar orders still in play. Ideally, when they make money, Bang Trades makes money!

Shadow Trader

This is my flagship, longest-running and most popular strategy. It taps into institutional order flow in the options market — AKA unusual options activity.

I use my proprietary scanner to uncover what the “big money” is buying, then I filter the best, high-probability positions based on a number of factors, and then we follow that big money.

Weekly Trade Alliance

This is my bull put credit spread strategy that can work in flat, up and even down markets — and it doesn’t rely on directional moves for it to pay off. Think of it as a way to diversify your trading strategies and potentially collect weekly options premium.

Wiretap Alerts

With this service, I take advantage of a phenomenon that happens every Friday around 3 p.m. ET. We also target unusual options activity on a select group of stocks. In order to keep these trades as cheap as possible, we go with short-term expirations, entering Fridays before the close and generally exiting the positions the following Monday — in and out!

— — —

So that about sums everything up as far as the different strategies.

When it comes to risk management, here are some general rules of thumb for a $10,000 trading account…

Profit targets are set at 50% and 100% returns, with any leftover contracts kept open to try and reel in even bigger gains.

Since I like contracts around $1.00, and to keep things simple for this example, that means the first and second profit targets will be $1.50 and $2.00.

- 10 contracts at $1.00 = $1,000 of total risk.

- Sell four contracts at $1.50 (profit target No. 1).

- Sell four contracts at $2.00 (profit target No. 2).

- Let the balance of two contracts ride.

I do not personally use stop losses because options prices can make wild swings from one minute to the next, but you can set one at 50% if you so choose. I also don’t generally add to losing positions unless I feel strongly about them rebounding.

When it comes to position sizing, I usually recommend small, medium and large positions.

- Small: 2% to 4% of account balance for earnings trades or more risky weekly options.

- Medium: 5% to 7% of account balance, generally front-month expirations.

- Large: 10% of account balance, generally only for high-conviction trades that don’t expire for 30 days or more.

P.S. Want to Trade Tuesday’s Open With Me?

At 9:30 a.m. ET on Tuesday, June 20, we’re doing another free scanner session…

Last time we did this was the Tuesday following Memorial Day weekend.

And that Tuesday morning was nuts!

We saw heavy and aggressive options flow right out of the gate…

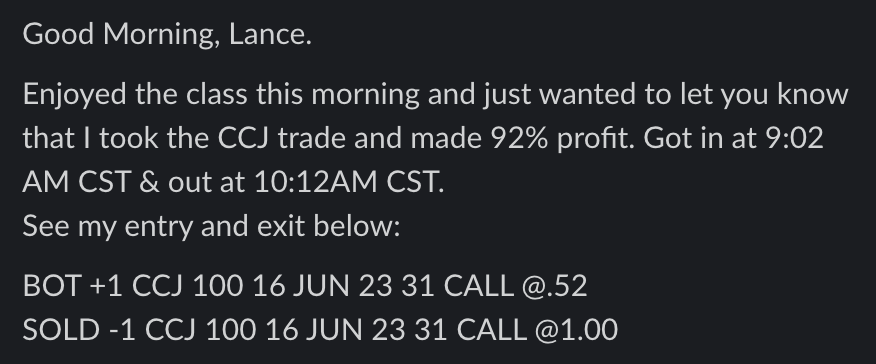

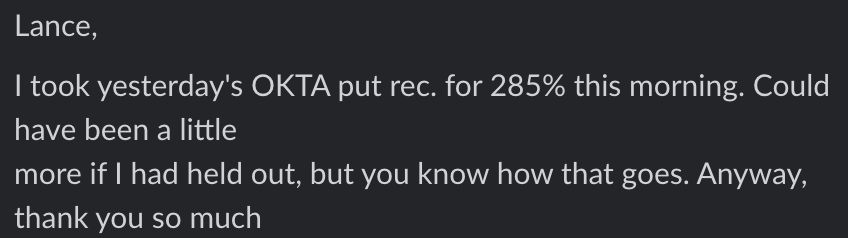

The two that stood out were CCJ and OKTA…

And a bunch of you got in on the action too!

That being said, this Tuesday following the Juneteenth market holiday, I think we’ll see some aggressive buying right at the market open again.

So we’re doing ANOTHER free live trading session, and everyone’s invited!

So if you want to join us for what should be an exciting trading session.

All you need to do is go here and save your seat…

And I’ll see you on Tuesday!

The profits and performance shown are not based on any sort of typicality, they were real scanner signals that various members traded. We make no future earnings claims, and you may lose money.